-

6 in 10 experience significant anxiety over their daily finances.

6 in 10 experience significant anxiety over their daily finances. -

5 in 10 have dipped into retirement accounts for emergencies, showing a worrying trend toward using long-term savings for short-term needs.

5 in 10 have dipped into retirement accounts for emergencies, showing a worrying trend toward using long-term savings for short-term needs. -

4 in 10 are managing student debt, with 68% reporting moderate to severe anxiety because of it.

4 in 10 are managing student debt, with 68% reporting moderate to severe anxiety because of it. -

9 in 10 with student loans say resuming payments impacts their ability to save for retirement.

9 in 10 with student loans say resuming payments impacts their ability to save for retirement.

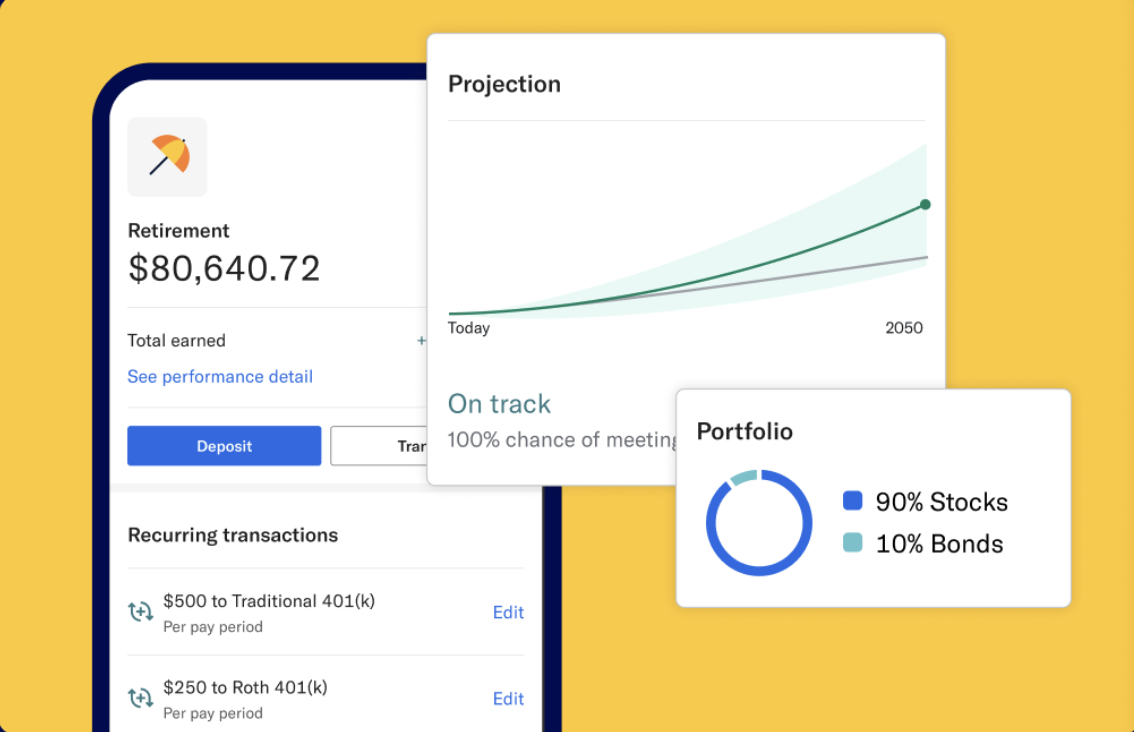

Watch this short video to learn more about Betterment** and how their retirement platform helps you attract and retain talent.

%20(2000%20x%20400%20px).png?width=2000&height=400&name=Betterment%20(2000%20x%20600%20px)%20(2000%20x%20400%20px).png)